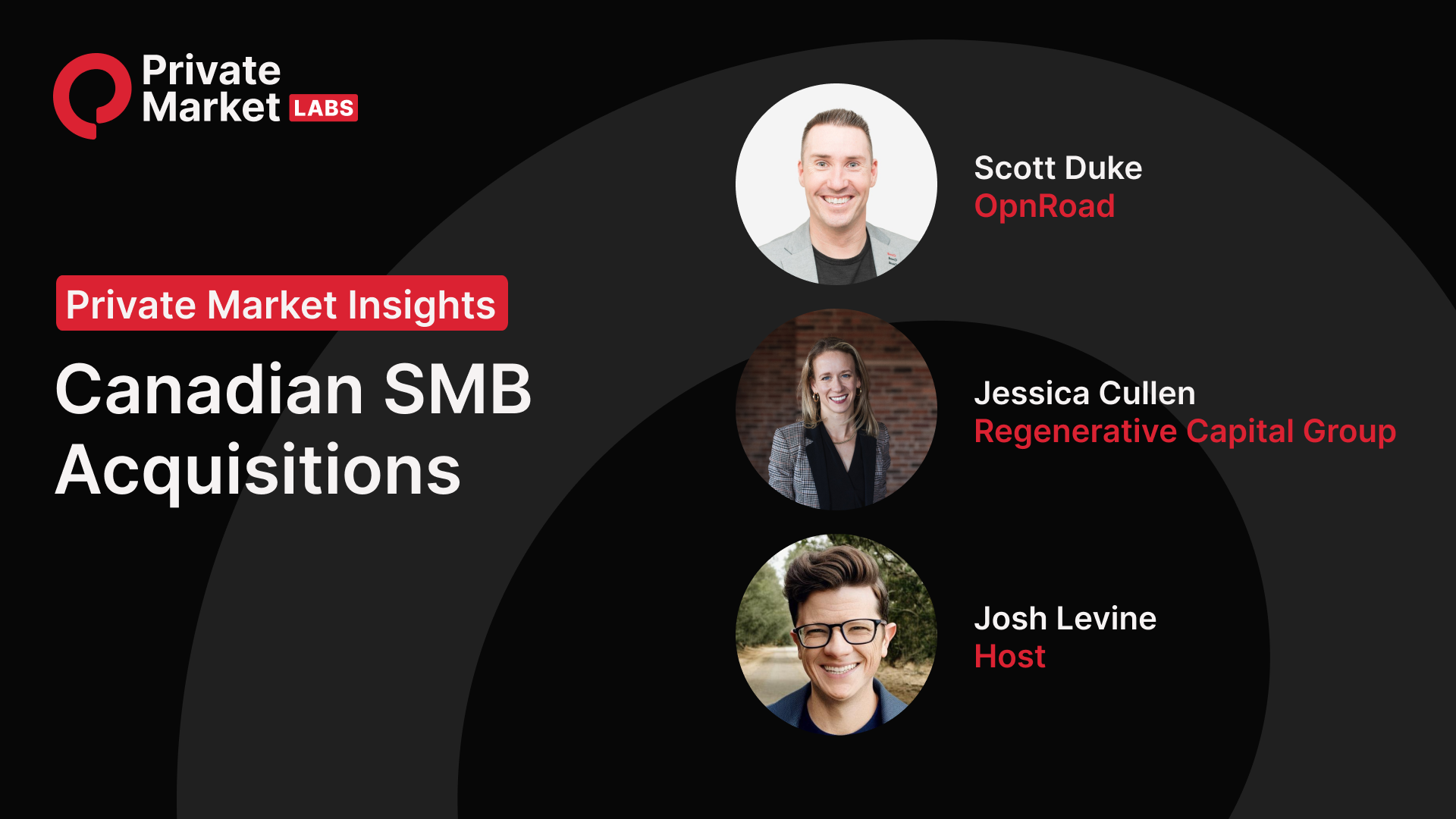

In the 30th episode of Private Market Insights, we continue exploring international search and SMB acquisitions, focusing on the Canadian market. Our guests are Jessica Cullen, a traditional searcher and professional triathlete, and Scott Duke, the founder and lead M&A advisor at OpnRoad, a Canada-focused sell-side advisory firm.

The discussion highlights the key differences between the Canadian and US search markets, focusing on the importance of trust, authenticity, and personalization when building strong relationships with sellers. Jessica and Scott share insights on the challenges of accessing capital in Canada compared to the US, as well as the need for searchers to showcase their leadership potential and industry-specific knowledge when engaging with sellers.

Throughout the episode, Jessica and Scott offer valuable advice for both Canadian and US-based searchers looking to navigate the Canadian SMB market successfully. They emphasize the significance of partnering with local experts, understanding cultural nuances, and educating business owners about the search fund model.

For more in-depth discussions on topics such as the future of the Canadian search market, the role of technology in the M&A process, and how search can enable a balanced lifestyle, we highly recommend watching the full episode:

“I find that in Canada, whether I’m talking to a business owner or a relative, they have no idea what search is, whereas it’s a common household conversation in the States.”

Jessica Cullen

Trust and Authenticity Are the Foundation of Buyer-Seller Relationships

Jessica believes trust is the most critical factor in building strong relationships between buyers and sellers. She emphasizes the importance of being completely authentic and honest about who you are and what you’re looking for in a company from the very first meeting. Scott agrees with Jessica’s perspective and emphasizes the importance of digging deeper into the seller’s motivations and objectives beyond just the financial aspects of the deal. He notes that even if a searcher only plans to acquire a single company, building trust and establishing a long-term relationship with the seller is essential. This approach helps facilitate the current transaction and lays the foundation for future business opportunities.

Personalize Your Search and Showcase Leadership Potential

Both guests emphasize the importance of personalizing your search and outreach to sellers, which aligns with our recent article on this topic. Searchers should tailor their initial messages, follow-up strategy, and questions to each specific deal, demonstrating their knowledge and connection to the business. Scott highlights the need for searchers to refine their search criteria and focus on a particular niche, allowing them to curate a more targeted list of potential sellers. This is important because sellers are not only evaluating the searcher’s ability to acquire the company but are also examining their capacity to effectively run the business post-acquisition.

Differences Between Canadian and US Search Markets

The Canadian SMB acquisitions market is not as developed as the US market, with a smaller population and fewer businesses for sale. With smaller overall service areas, particularly in rural parts of the country, many companies take a generalist approach, offering multiple services to their communities. Additionally, search funds are relatively new in Canada compared to the US. Our guests notice that some Canadian business owners are more receptive to Canadian searchers and may be hesitant to engage with searchers from the US. Given the lack of familiarity with the search fund model in Canada, searchers can gain a competitive advantage by educating business owners about the process, the different players involved, and what to expect when selling to a private equity firm. This helps build trust and nurture relationships with potential sellers.

Financing is More Difficult in Canada than in the US

Access to capital for search funds and business acquisitions is more limited in Canada than in the US, as Canada does not have an equivalent government lending product to the SBA 7(a) program. Canadian searchers rely on traditional banks, which offer loans at slightly higher interest rates, and the Business Development Bank of Canada, a subprime lender with more favorable terms but higher rates. Given these challenges, many Canadian searchers join traditional search funds (including Jessica), rely on self-funding, or seek capital from US-based buyers and investors to acquire businesses.

Search as a Blueprint for Achieving a Balanced Lifestyle

As a professional triathlete, Jessica finds that search allows her to maintain a balanced lifestyle while pursuing her athletic career. Engaging in regular training gives her the energy to perform at her best both in search and in her personal life. Like Jeff Driskel, another recent professional athlete guest, Jessica draws parallels between the discipline and resilience required in professional sports and the search process, noting that both involve consistent effort without immediate results. As an individual sport athlete, Jessica has more flexibility than Jeff. She can prioritize her search activities when needed, and can cancel races without substantial financial consequences, allowing her to allocate time efficiently between her two passions.

Avoiding the “Tourist Trap” in Canadian Search

In the previous episode of the podcast, our guest Tristan Maher advised searchers not to be “tourists” in the foreign market where they’re searching. Scott and Jessica echo this sentiment in the context of being a foreigner searching for businesses in Canada. Scott emphasizes the importance of working with local partners who understand the nuances of the Canadian market and having industry-specific knowledge through self-education or by partnering with experienced consultants. Jessica stresses the value of personalization, regionalization, and building genuine relationships within the target industry. For non-Canadian searchers, she recommends partnering with a local Canadian to navigate the market more effectively.

The Future of the Canadian Search Market

Jessica anticipates that Canadian business owners will become more familiar with the search fund model as they are increasingly contacted by searchers. She notes that the current environment is ripe for Canadian searchers, with business owners even reaching out to her proactively to explore potential acquisitions. However, as the market matures, Jessica expects it to become more challenging for searchers to find opportunities.

On the other hand, Scott hopes to see more consolidation in the Canadian market, as there hasn’t been significant activity in this area across industries. He also expects a gradual exit of baby boomer business owners rather than a sudden wave, as many owners are working well into their 70s.

Scott said, “We’ll see a trend of people exiting. There’s the ‘gray hair tsunami’ or whatever you want to call it – all the baby boomers exiting. It’s interesting because everyone thought it was going to happen all at once, but it’s not.”