Private Market Labs versus Kumo

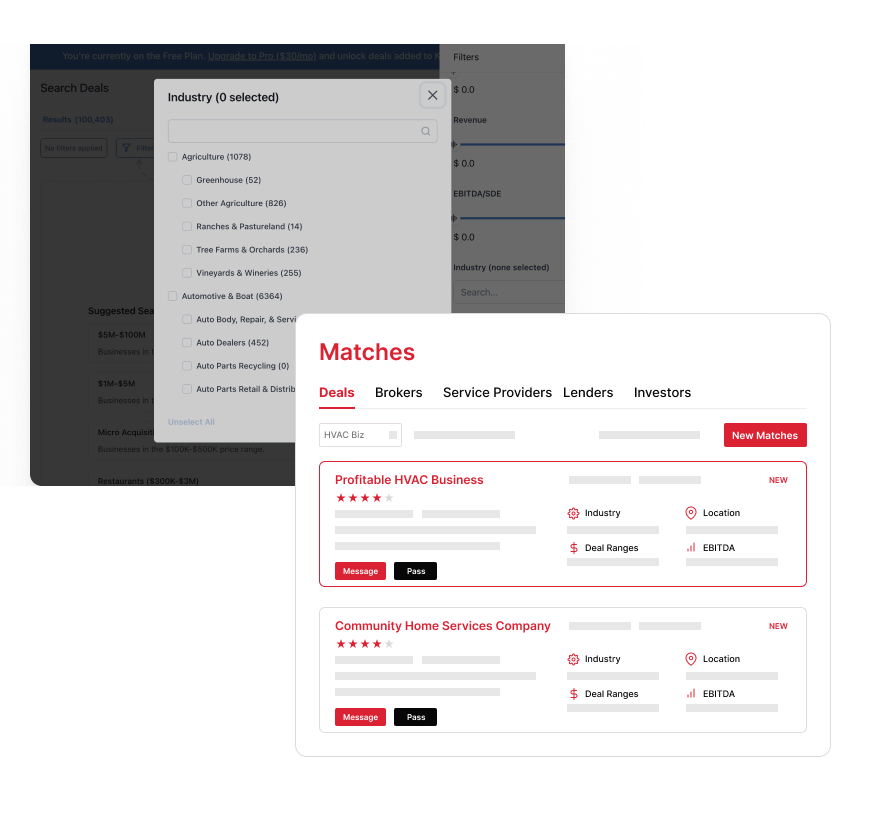

Private Market Labs and Kumo are two modern platforms for small business M&A. While Kumo made waves a couple of years ago due to its aggregation of broker websites, the introduction of Private Market Labs, with a similarly-sized pool of deals and tailored matching algorithms, quickly threatens to make Kumo obsolete.

7 day trial, no credit card needed!

Choose To Work With The Best

Head-to-head Comparison:

Feature

Deal Identification System

Number of Deals Available

Price

Specific Broker Insights

Industry Data / Publications

Assisted Outreach

Private Market Labs

AI-powered SMB Match

65,000-80,000

Free trial, then $49/month

Match with best-fit Brokers

Insights Podcast

Custom Buyer Profiles

Kumo

Simple filters and dropdowns

$100/month

None

None

A match for both general and specific searches

Only with SMB Match

Private Market Labs deal and intermediary data

Access one of the largest unduplicated, consistently formatted dataset of businesses for sale and their sell-side representatives in the industry. Get matched with over 75,000 active businesses for sale from over 6,500 firms and more than 20,000 intermediaries based on your search thesis.

What Our Customers Are Saying

Accurate Matching & Easier Deal Management with Machine Learning Tools

1. Search

Get matched with deals and intermediaries that meet your precise investment thesis, no matter how narrow or broad.

2. Finance

Access capital providers that meet your search strategy, including lenders and equity investors.

3. Due Diligence

Connect with Pre-LOI, LOI and due diligence service providers to set up for a successful acquisition.

Operate

As a new business owner, access tools and services to run a profitable company.

Sell

When it’s time to move on, partner with advisors, service providers, and buyers to get the best deal.

Data from +2,000 Websites for Informed Acquisition Decisions

For buyers in the private market, having the right information is key. We build extensive partnerships and gather data from thousands of quality sources to ensure you find the best opportunities for your search. This thorough sourcing is what powers our extensive database, offering buyers like you the detailed insights needed for strategic acquisitions.

How it works

Step 1: Match with Listings

Leverage our advanced matching technology to identify the most promising acquisition opportunities.

Step 2: Easy Target Management

Manage your matches in platform. Save the deal and intermediary connections that are most promising

Step 3: Engage with Brokers

Leverage the platform messaging system to contact intermediaries about specific deals or about their expertise.

Step 4: Return for New Deals

Keep coming back to the platform to get the latest data updates. We continuously monitor the market for you.

Find the right matches

Whether you're looking to buy and operate or simply invest in a skilled entrepreneur's acquisition, this is the right place. Create your profile and gain access to deal flow, capital providers, due diligence professionals, and service providers.

7 day trial, no credit card required!

Why Buy an Enduringly Profitable Small Business on Private Market Labs

Most publications credit Irv Grousbeck with the creation of the search fund model and the beginning of search strategies. A former media executive-turned-Harvard professor, Grousbeck created the first search fund in 1984. Search Funds get their name from the initial entrepreneurs who “searched” for companies to acquire with their own capital rather than relying on outside funding sources such as venture capitalists or banks. Since then, search fund activity has grown significantly with more than hundreds successful transactions over three decades.

At Private Market Labs, we consider a search fund to be any small group or individual undertaking a proactive process to find and acquire an existing business based on target factors such as geography, industry, deal size, business type and other criteria. Typically this takes the form of a single-acquisition or multiple-acquisition “search”, where the buyer uses a mix of debt and investor capital to purchase and operate successful small businesses generating meaningful cash flow.

You’ve come to the right place! We’ve put together a whole suite of resources for people looking to get into search. There are two pieces in particular that can be very helpful for beginning searchers:

- An introduction to key terminology.

- A breakdown of the steps involved in buying a small business (this is the maximum number of steps, some people acquire faster. Fortunately we’re here to help).

First and foremost, buying a business comes with a different operating risk profile. Most people look to buy businesses that already have substantial profits, allowing them to achieve their entrepreneurial goals while still making a meaningful salary. Most startup ventures require substantial investment of time and resources up front, before the founder ever achieves any financial stability. Additionally, most startups fail, meaning that the entrepreneur’s up front investment frequently generates very little in the way of returns.

When you buy a business, you’re taking the personal resources you would have invested in your startup and using them as a downpayment on an enterprise that is already profitable, skipping the painful “0 to 1” part of the process. While buying a business does come with risks (for example, you’ll likely be required to put down your personal assets as collateral on a loan to complete the transaction), the operating risk is substantially lower.

We put together a set of stories, describing the kinds of small business transactions that we see in our industry. Check it out, and see if you recognize yourself in any of these entrepreneurs.

There are a number of options for aspiring small business buyers. The most common one is the SBA 7a program, which is a government-backed loan program used in transactions $5M and under. We partner with a number of SBA lenders at Private Market Labs. Here are conversations we’ve had about the program:

Jarryd Osborne (buy-side broker)

Heather Endresen (SBA loan broker, former lender)

Lisa Forrest and Sarah Andrews (SBA lenders)

There are also a number of ways to buy a business without using an SBA loan. We published on that as well.

After doing your research, your first decision is going to be around the search model you’d like to use. There are “traditional” searches where buyers raise funding from outside investors to buy larger businesses.

There are also “self-funded” searches, where buyers primarily use personal assets and debt to acquire a smaller business with more personal ownership. You can read more about the different types of search.

You’re in the right place! Private Market Labs is the modern, efficient, and technologically-enabled way to find small business deal flow. We focus on deals represented by business brokers. We like these deals because they have motivated sellers who are supported by advisors incentivized to get deals done. As a result, brokered deals close at higher rates than off-market deals. To learn more about the different kinds of deal flow in our space, check out this article and this conversation with Steve Ressler.

Once you have your deal in hand, there are several next steps. People using an SBA loan will want to work with their lender to make sure the deal is doable for the bank. You’ll want to conduct thorough due diligence on your deal to make sure you understand any risks associated with the company itself. We’re partnered with DueDilio to provide just-in-time connections to vetted experts for due diligence. You can request help directly in the platform! Here are some additional resources about the due diligence process:

- How to build a top-notch due diligence team.

- Managing search fund costs.

- How to manage the due diligence process (conversation with the DueDilio founder).

Simple & Transparent Pricing

Search

Unlimited search themes

Unlimited contact saves

Easily manage your opportunities

7 day free trial

Enterprise

Custom plans for large or multi-searcher organizations (accelerators, support organizations, etc.)